How much oil is left to us? When will fuels be exhausted?

2001/12/01 Mujika, Alfontso - Elhuyar Fundazioa Iturria: Elhuyar aldizkaria

Primary energies present on Earth (oil, mineral coal, natural gas, wood, uranium, etc.) Oil and natural gas are the most important: more than 60% of the primary energy currently used in the world comes from oil and natural gas. Just over 100 years ago we began to exploit oil industrially, while the use of natural gas is much more recent. Oil is of great importance in transport, heat generation and the chemical industry; natural gases in the chemical industry and the generation of electricity and heat. Only 5% of the total production of oil and natural gas is destined to the production of materials in the chemical industry, such as plastics. This percentage is recyclable and reusable, so it is not lost. The remaining 95% is burned, so it cannot be reused.

Hydrocarbons (oil and natural gas) are limited resources. Nature has taken millions of years to produce the annual amount of oil and natural gas we are consuming in the world, and, taking the whole history of mankind, the era of oil is a very short period. The duration of the era of hydrocarbons, that is, the exhaustion of oil and natural gas, is a very interesting question and all over the world experts are defining their answer. To get into the topic you have to clarify some terms. The following table shows the classification of hydrocarbons.

What are the reservations?

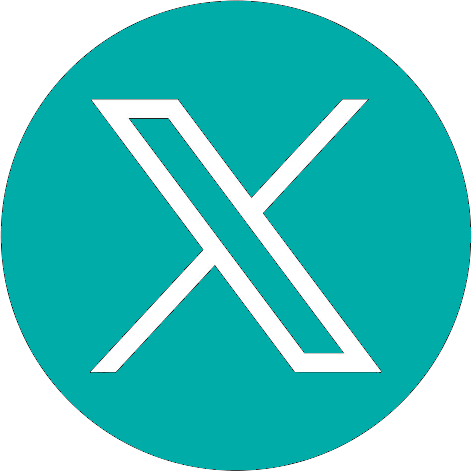

Quantities of hydrocarbons found in the deposits and which can be obtained economically profitable with the current technology. As for conventional crude oil, it reserves between 30% and 50% of the actual amount of oil deposited in the pit. As for conventional natural gas, between 60 and 90%. The rest of the oil or natural gas found in the pit is not currently economically profitable.

What are the resources?

Amounts that have been geologically detected but that in the current conditions cannot be obtained economically profitably, as well as, although they have not yet been detected, on the basis of geological reasons, what is expected to be found in a certain region (still to be discovered). As with reservations, only the amount really possible is taken into account. Regarding booking data, resource data is not very accurate, but this is normal because there is less specific information about resources.

When analyzing the global state of reserves and resources, only conventional crude oil and conventional natural gas are taken into account. Between the 1940s and early 1980s, experts have made increasing estimates of the maximum amount available in crude.

Since then, expert estimates have stabilized between 200,000 and 400,000 million tons. According to the German BGR (Bundesanstalt für Geowissenschaften und Rohstoffe), the maximum estimate (GZ) for the year 2000 is about 360,000 million tons. The US organization USGS (United States Geological Survey) values GNO (natural gas emissions) at 450,000 million tons.

As has already been indicated, the value of the BA has been increasing historically, but the growth is less and less, approaching asymptotically to the maximum value.

What if there is more oil?

Experts know very well where oil deposits can be still to be discovered. Therefore, the spectacular discoveries of the new giant deposits will hardly happen, since their distribution is limited by depth and temperature. Therefore, the most important factor that could increase the value of BA is the increase in the percentage of acquisition in the already known niches. Currently, the acquisition coefficient ranges from 0.3 to 0.5, that is to say, a maximum of half of the oil present in the deposits. However, to increase this coefficient, it is necessary to improve the extraction technology and increase the price of oil to make the extraction of oil that is now in the deposits.

If oil production is considered to be constant from now on or is going to rise gradually, half of the conventional oil that exists in the world according to the GZ will be drawn from here to 10 and 30 years. At this moment it is called ‘middle point of exhaustion’ and will mark a significant milestone in oil production. In fact, historical production curves in well-known deposits show that oil production begins to decline if this point is reached.

And natural gas?

As for natural gas, according to who indicates it, the value of the IBI is 350 and 500 billion cubic meters. The value of the German BG has been 418 billion cubic meters and the US USGS of 436 billion. Since the 1980s, the value of the BA has been on the rise due to increased reserves and resources. In addition, the natural gas sector has been developed intensively in the last 20 years due to the increase in the price of oil and the desire to protect the environment and diversify energy sources, which has meant a considerable increase in geological knowledge. However, the exploration of gas is not as developed as that of oil.

Figure 1 shows the GZ and the duration of oil and conventional natural gas. To the left of the image is clearly seen the critical state of conventional oil. 35% of the world's oil has already been used and the peak of production will arrive soon: the average point of exhaustion will be between 2010 and 2030. According to the announcement of the International Energy Agency of 1998, with a growth rate of 2 per cent per year, half of the current oil in the world will have been removed within 25 years and most of the reserves that are known today will be exhausted.

The state of natural gas is much better. In the right part of the image it can be seen that to date only 15% of the world natural gas has been used. Assuming an increase of the annual production of 3%, as announced by the International Energy Agency, by 2025 almost 40% of the IBI of natural gas will have been exhausted (situation in which oil is currently found). It will not reach the average point of exhaustion in 2025, even with a growth rate of 6%. In addition, the average point of exhaustion is less significant in the production of natural gas. In fact, the production of gas deposits is quite constant even after the average point of exhaustion.

And the price of oil?

The price of oil has suffered notable variations in the last 25 years, as examples of the “oil crisis” of 1973 and 1979, and of the post-1997 vicissitudes. The price change has important consequences: large price increases are a serious burden for oil importing countries, but they also have positive consequences, as it encourages consumers to save this raw material.

When the price rises, oil companies are more prepared to increase exploration and start the exploitation of oil fields than before were not considered profitable. At the other end, if the price of oil falls too low, it seems to benefit consumers, but the fall will reduce the income of oil exporting countries, thus weakening the effort to look for new deposits. This means that after a season bookings will decrease and, therefore, the price will rise. Price increase in case of lack of supply.

Technicians and scientists say that it is practically impossible to make reliable predictions about the price of oil, since many factors that cannot be calculated influence the price. For example, the US Department of Energy announced that the price of oil in 2020 will be 22.5 dollars per barrel, and the International Energy Agency announced a price of 28 dollars: Oil has already exceeded these two price limits in 2001. It is not possible, therefore, to make reasonable predictions, but it can be predicted that in the future the price of oil will suffer great short-term variations.

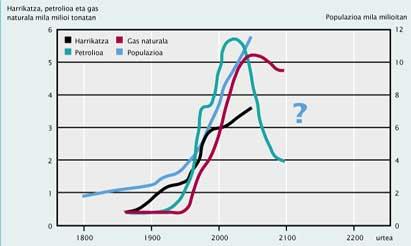

Figure 2 shows the evolution of the world population and the consumption of fossil fuels since 1800, as well as its possible evolution until 2100. The peak of oil production seems to be the XXI. that will arrive in the first half of the twentieth century and natural gas in the middle or after the twentieth century. Coal production will increase in absolute numbers, but its participation in primary energy is being reduced. It is estimated that energy consumption will increase, especially due to the increase in the population in developing countries.

The production of oil, and later of natural gas, will be forced to be reduced. The oil and natural non-conventional gases, whose quantity is estimated to be higher than that of conventional hydrocarbons, may supply the vacuum, but only partially, with much higher production costs, overcoming technological and environmental problems. Given this situation, and taking into account the problem of climate change, it is essential to learn how to save oil and natural gas. And research to find suitable alternatives to hydrocarbons should be a priority role.

Oil (raw) Conventional crude oil

Unconventional oil

Conventional natural gas

Unconventional natural gas

|

Gai honi buruzko eduki gehiago

Elhuyarrek garatutako teknologia