End of stolen checks

1988/08/01 Elhuyar Zientzia Iturria: Elhuyar aldizkaria

PVC (Potection contre les chèques volés), a non-profit organization formed by banks and traders to combat this epidemic. This system offers a simple, fast, safe and economical solution to the problem.

The association works in coordination with the police and judicial authority to identify adulterants.

After two years of operation of the PVC system in Strasburg, it has been launched in Bordeaux and Nîmes with great success. In Strasburg, from a survey conducted in 1987, it was concluded that, after its accession to the system by independent traders, no stolen check was received.

Like all great ideas, this system is very simple. It is enough that a minitel who answers, is asked if the cheque given to him by the client is in the file of fake checks that have updated the banks. The trader will obtain this information after typing the confidential entry word that was delivered to him at the time of his accession.

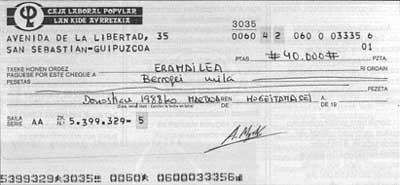

They are based on the line of figures on the bottom of the checks to consult information. In this line there are three groups of figures: the set of the left is the check number that identifies the bank and the branch and the one of the right the account number.

The trader will type in their mini-bar the following account number after typing their identification number. If there was something suspicious, I would type the check number to check if the check is in the file of stolen checks from banks.

The files used by PVC are box office files of the banks adhered to the system, that is, any change in the list of checks would be known immediately the trader. Therefore, traders have information as complete and updated as bankers.

This file subject to interbank rules has the following advantages:

The possibility of dealing with checks of all banks operating in France, being limited to the information provided by the bottom line of checks, being able to carry out the transmissions with total agility and reliability, and finally, its character not nominal (it is not possible to introduce the name of the holder of the talonario).

As for the cost, traders pay an initial fee and then are given the entry word or if they wish the card with specific memory. They must also pay an annual fee. Rates vary depending on individual traders, large areas or supermarkets, or hypermarkets.

Gai honi buruzko eduki gehiago

Elhuyarrek garatutako teknologia